Michigan could gain millions in tax revenue in legal marijuana market

LANSING — A fully developed legal market for medical marijuana in Michigan could lead to millions of dollars in new state tax revenue.

Exactly how much is open to interpretation, but some analysts’ estimates suggest it could top $63 million a year.

New regulations for the state’s medical marijuana industry, signed by Gov. Rick Snyder and taking effect in December (though a licensing system won’t be active until December 2017), will require a 3 percent excise tax on dispensaries’ gross sales receipts.

That could yield $21.3 million annually in revenue to the state, based on roughly 204,000 registered medical marijuana patients in the 2016 fiscal year, according to the Senate Fiscal Agency. The agency estimated Michigan’s medical marijuana market could exceed $711 million, should prices and customers’ buying habits mimic those in Colorado, which has a more established market today.

More coverage: A budding market for risk-taking pot entrepreneurs

Additional revenue is expected if marijuana retail sales are subject to Michigan’s 6 percent sales tax — to the tune of $42.7 million — and with the collection of state and local licensing fees, the fiscal agency wrote.

Michigan could be the third-largest state medical marijuana market by 2020, with $556 million in projected sales that year, according to a 2016 report from ArcView Market Research, which analyzes cannabis industry trends and statistics through San Francisco-based The ArcView Group. Michigan would rank behind California and Colorado, and ahead of Arizona and Oregon, the report suggests.

This year, legal marijuana sales in the U.S. could reach $7.1 billion, up 26 percent from 2015, according to ArcView. The figure includes recreational adult use. It estimates legal marijuana sales in the U.S. will top $22 billion by 2020, with recreational adult use comprising slightly more than half of total sales.

The Tax Foundation, based in Washington, D.C., forecast in May that a mature cannabis industry could produce as much as $28 billion in tax revenue at federal, state and local levels.

“The industry supporters, the people advocating for it, want to tax it because they view (taxation) as a step toward legitimizing it,” said Joe Henchman, vice president of legal and state projects for the Tax Foundation. “It kind of scrambles some of the traditional narratives.”

Even among advocates, though, is the concern in Michigan that new taxes and other regulatory fees will raise the price of marijuana products, potentially to the point they’re no longer affordable, said Paul Armentano, deputy director of the National Organization for the Reform of Marijuana Laws, or NORML, a Washington, D.C.-based advocacy group.

“The notion is, what we do not want to do is attach so many fees associated with the legal market that that market can no longer compete with the illegal market,” Armentano said, “and therefore we continue to allow that illegal underground market to flourish.”

There is some evidence that could happen. The Tax Foundation studied tax structures in the four states that legalized recreational adult use of marijuana; several initially imposed tax rates in the double digits, according to the Tax Foundation. Some of those states now are lowering their rates, Henchman said.

Colorado, for instance, charges a 15 percent tax on the wholesale marijuana price and a 10 percent state tax on the sales price; the latter will go to 8 percent in July 2017, according to the Tax Foundation.

Washington state charges a 37 percent excise tax on the retail sales price, while Oregon levies a 25 percent excise tax on the sales price; Oregon’s rate will fall to 17 percent later this year.

“A lot of people switched, but not enough, and that suggested the rates were too high,” Henchman said. Lowering rates could be a way to ensure taxes are “not so high that it’s inducing people to go and find a black market dealer.”

Gary Wolfram, William E. Simon professor in economics and public policy at Hillsdale College, in February published a report estimating that Michigan’s excise and sales tax windfall from the new regulations would range from $44.3 million to $63.5 million annually. The lower amount was based on several factors, including roughly 182,000 registered patients in Michigan in the 2015 fiscal year and an assumption that two-thirds of them would buy marijuana from a licensed dispensary.

The amount could increase to $52 million if 80 percent of current patients bought cannabis from a dispensary, and $63.5 million if Michigan’s patient count increased to 219,000, Wolfram found.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

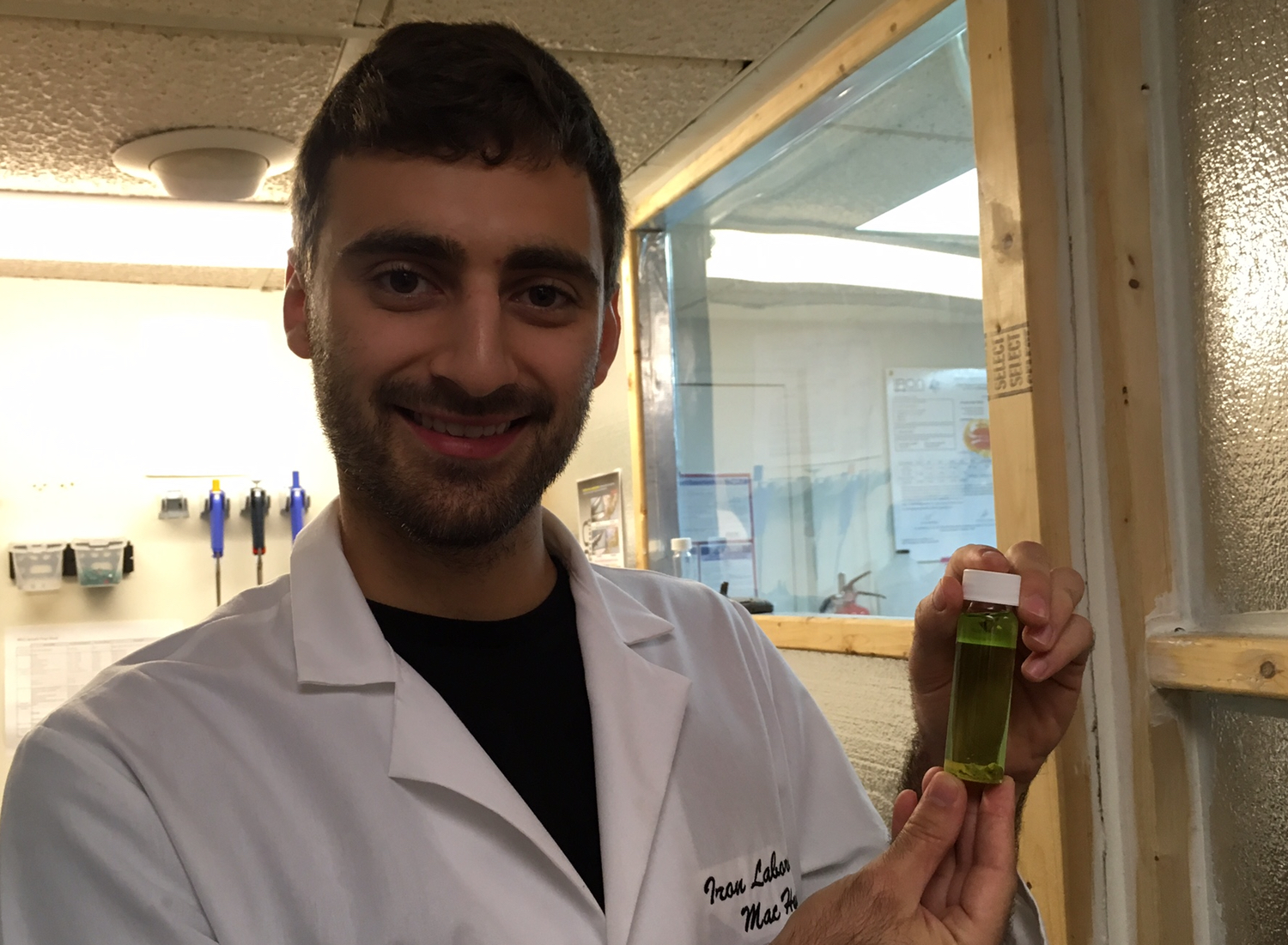

Mac Hyman, lab manager at Iron Laboratories in Walled Lake, holds a marijuana sample prepared for testing (The green tint is chlorophyll). The legalized marijuana industry is expected to bring in millions of dollars of new revenue to the state.

Mac Hyman, lab manager at Iron Laboratories in Walled Lake, holds a marijuana sample prepared for testing (The green tint is chlorophyll). The legalized marijuana industry is expected to bring in millions of dollars of new revenue to the state.