Despite economic growth, Michigan budget to face steep challenges

With his signature in mid-July, Governor Snyder put to bed the state budget for fiscal year 2018. Eight years removed from the end of the Great Recession and benefitting from an expanding state economy and projected solid revenue growth, this year’s budget process was a pretty typical affair.

The $56.5 billion total spending plan, which takes effect October 1, includes $10.0 billion in appropriations from the state’s discretionary General Fund checkbook, about the same amount authorized in the current year. While budget deliberations this year centered around maintaining current spending levels or marginally increasing funding in specific areas (e.g., all levels of education), a new report by our group, the Citizens Research Council of Michigan, shows that a number of decisions made by previous legislatures will muddy the waters, making the challenge of balancing the state budget much more difficult in future years.

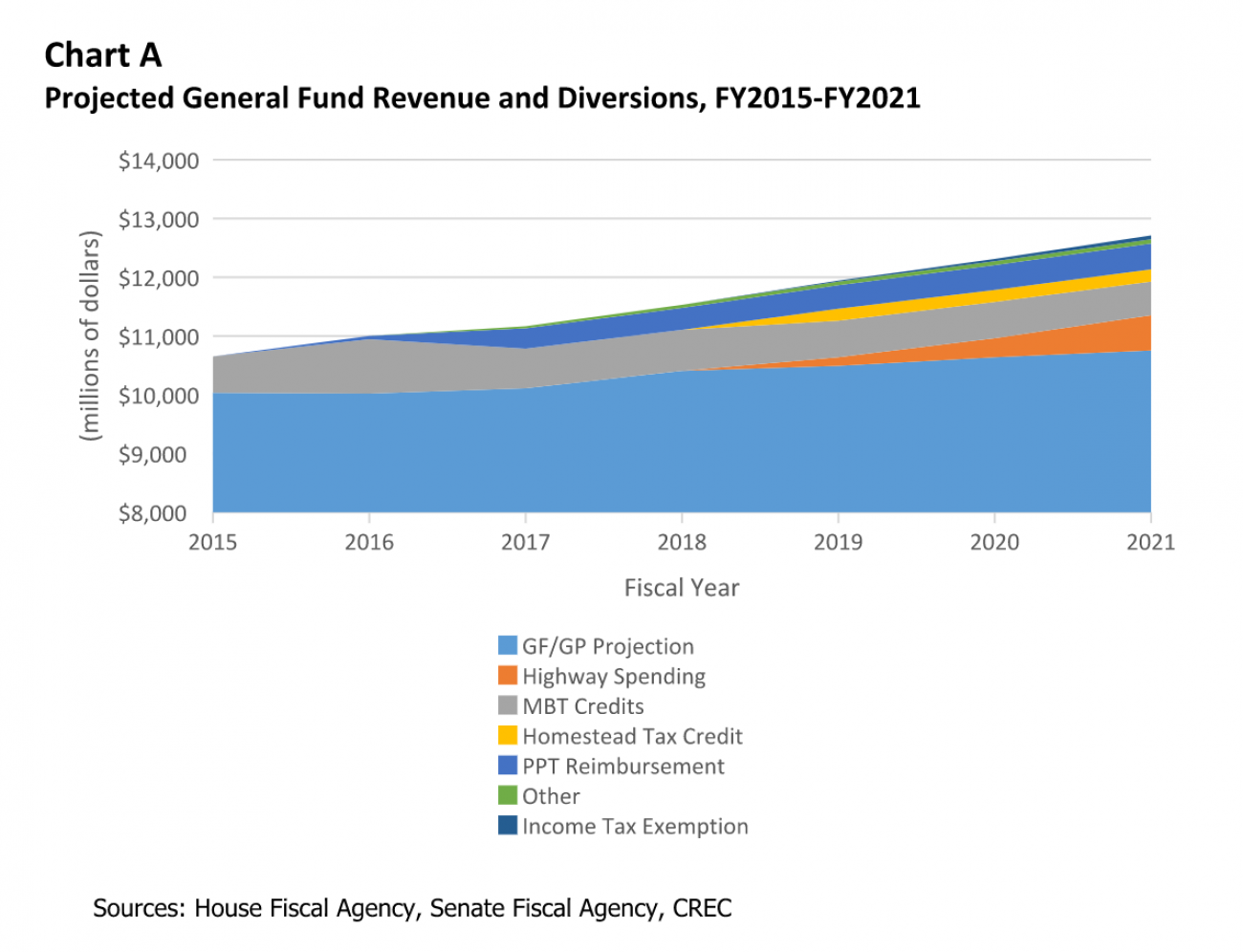

Despite projections for continued economic growth, the General Fund is not expected to grow over the next three years relative to inflation because of a few major revenue diversions, including some that have yet to come online.

Although the Corporate Income Tax has served as the primary business tax for more than half a decade, many businesses continue to file under its predecessor, the Michigan Business Tax, so they can claim tax credits enacted during Michigan’s single state recession. Those credits reduce potential revenues by around $600 million annually, and will continue to drain discretionary resources for years to come.

The 2015 transportation investment package will eventually provide an additional $1.2 billion for road and bridge funding with approximately half coming from additional taxes (increased fuel taxes and vehicle registration taxes) and the other half from income tax revenues that would otherwise flow into the General Fund. The General Fund contribution will start in FY2019 at $150 million and ramp up to $600 million in FY2021.

Additionally, the transportation package included expansions to the Homestead Property Tax Credit for low-income households as an offset to the fuel and vehicle tax increases. These tax credits are expected to draw an additional $200 million from the General Fund annually beginning in FY2019. All told, the transportation package will reduce money flowing into the General Fund by $350 million in FY2019 and $800 million by FY2021.

Another noteworthy revenue diversion comes from the 2014 plan to expand exemptions on business personal property. The state agreed to reimburse local governments and school budgets for the revenue loss associated with exemptions for industrial and commercial personal property. To make local government and school budgets whole from the state exemptions, a portion of the state Use Tax will be used as a dollar-for-dollar replacement, costing the General Fund $500 million annually by FY2023.

In addition to these and some other smaller revenue issues, a smattering of upcoming spending increases will put more pressure on the budget as state costs for the Healthy Michigan Plan and the Michigan Indigent Defense Commission will begin to come due. All told, our new report estimates that more than $2 billion in potential General Fund revenue will be diverted or dedicated to these programs by FY2023, which accounts for 20 percent of the state’s General Fund budget.

Compounding factors could make the state’s budget even more difficult to balance in future years. Congress may look to cut federal spending, which could impact dozens of state-administered programs, particularly Supplemental Nutrition Assistance Program (formerly known as food stamps) and Medicaid, and could reduce the federal money coming to Michigan by billions of dollars, forcing choices if that spending needed to be replaced.

Past experience shows that if and when the state’s economy cools, revenues from the income tax, which is responsible for two-thirds of all General Fund revenue, could decrease by up to 25 percent. Remember, Michigan is over eight years into the current economic expansion; the average length of previous ones was just under five years.

Revenue rules further compound problems by limiting the flexibility the legislature has to respond to revenue declines. Many revenue sources are directed to specific funds (for example, more than 70 percent of the sales tax is directed to the School Aid Fund), and where the money goes is set in statute or sometimes even the state Constitution.

In addition, increases to the individual exemption for the Personal Income Tax and a cap on the growth of Income Tax revenues constrains the growth of General Fund’s largest source.

The end result is that beginning with the FY2019 budget and well into the next decade, General Fund programs are likely to be facing increasing competition for a smaller pool of resources. The legislature will have to make decisions about what programs can afford to take cuts, and how to distribute them across the General Fund in order to maintain a balanced budget.

Healthcare, corrections and higher education spending make up the largest share of the General Fund budget; funding to each would likely be rolled back if cuts were made. This would mean limiting Medicaid benefits or enrollees and higher tuitions at state universities, along with cuts to dozens of smaller programs that rely on General Fund dollars.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!