What does Michigan have to do to get a little love?

So Michigan cuts business taxes by $2.4 billion, stages a political war (because that’s apparently what’s been lacking) that favors business over labor, more than balances the state budget and finally takes ownership of arguably its biggest challenge -- which is its biggest city.

And it’s still 39 spots below Indiana?

Yup. At least according to Chief Executive magazine, which, in its evaluation of state business climates, apparently failed to include a drive from Kalamazoo to Chicago so that the aesthetic charms of the Indiana Tollway might be graded.

Then again, I-94 on this side of the state line is one long rumble strip. But you don’t notice it as much when the fruit trees are in bloom.

What might explain Indiana’s No. 5 ranking among states, with Michigan dwelling in the cellar at No. 44.

Certainly not business taxes.

The Tax Foundation’s latest business tax climate survey in October evens things up a bit. Michigan was 12th, up from 19th since the Michigan Business Tax was scrapped in 2011. Indiana was 11th.

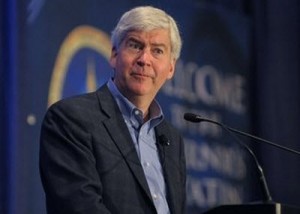

But Indiana’s edge in the ranking came from the property tax category. In December, Gov. Rick Snyder signed into law what eventually will be a $630 million personal property tax cut on business equipment, so that will change.

But Indiana’s edge in the ranking came from the property tax category. In December, Gov. Rick Snyder signed into law what eventually will be a $630 million personal property tax cut on business equipment, so that will change.

According to Chief Executive’s key metrics, moreover, Michigan bested Indiana in gross domestic product growth; had lower per-capita debt; had fewer government employees per 10,000 population; and had a lower state and local tax burden. At 9.3 percent versus Indiana’s 11.2 percent, Michigan's overall tax bite was below the national average, while Indiana's was higher.

But Indiana scored far better than Michigan because the survey of 736 CEOs was based on the respondents’ perceptions – and the national perception of Michigan remains fairly lousy. (Though there were comments from some who thought the Right-to-Work law was pretty swell.)

Where’s the ‘Snyder effect’ on economy?

Cemented biases take time to loosen. Snyder has been reticent about adopting a national sales profile. And Detroit now has fewer than 60 days to decide whether it’s going to be the largest case of municipal bankruptcy in American history.

But even if the policy changes pushed or accepted by Snyder haven't yet changed the perception that they have made Michigan a better place to do business – and thus will attract a lot of new outside investment to the state – surely they’ll produce a discernible response from the firms already here.

Maybe. Maybe not.

The consensus view from last week’s biannual revenue estimating conference in Lansing was that payroll employment growth in the last two years of Snyder’s first term would be less than that of the first two years, before the state’s latest economy plan really took effect.

According to University of Michigan economist George Fulton’s presentation, half the payroll employment growth from fourth quarter 2011 to fourth quarter 2012 was in manufacturing.

But manufacturing makes up only 13 percent of overall Michigan employment and the Michigan Manufacturers Association complained at the time that replacing a Michigan Business Tax with the new Corporate Income Tax actually represented a tax increase for many of its members.

Professional and business services, which represent a similar share of the job market as manufacturing, arguably benefited greatly from the elimination of state business taxes on partnerships and limited liability corporations. But employment in that sector grew at half the pace of manufacturing, fourth quarter to fourth quarter.

One of the arguments you kind of have to make for new policies is that the state will be better off with them in effect than if they were not. In this case, that business tax reduction on the massive scale approved in Michigan will produce a lot of employment bang for the buck.

You can argue that without the big shift in taxes from business to individuals, Michigan would be adding fewer than the 175,000 additional jobs U-M is forecasting for the state from January through the end of 2015. But since U-M doesn’t factor state tax changes into its employment forecast – and since Snyder’s Treasury Department is forecasting fewer jobs than U-M – even the Snyder camp isn’t making that claim.

The political difficulty is that such an economic payoff would seem to be critical for the re-election fortunes of anyone who promised it. Even if, by the end of 2015, payroll employment approaches the 4.2 million mark being forecast, that would still be less than the number of jobs in the state in 2007, before everything really went haywire.

And hitting that mark in less than three years depends on whether another forecast is met: light vehicle sales hitting 16 million, with the Detroit Three’s share of sales holding steady at around 45 percent.

In Michigan, in 2013, it's still all about the cars.

Perhaps the most important ranking remains this: For two decades, between 1990 and 2001, Michigan was a top 20 state when it came to per-capita personal income, reaching a high of no.17 in 1998, according to a compilation of state data by the Bureau of Business & Economic Research at the University of New Mexico. Michigan dropped all the way to no. 40 in 2009 and has since climbed back up to only No. 35.

There's still a long way to go. And how best to get there is far from settled.

Peter Luke was a Lansing correspondent for Booth Newspapers for nearly 25 years, writing a weekly column for most of that time with a concentration on budget, tax and economic development policy issues. He is a graduate of Central Michigan University.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

Gov. Rick Snyder has spared no effort in making Michigan "business-friendly," but the message has been slow to spread.

Gov. Rick Snyder has spared no effort in making Michigan "business-friendly," but the message has been slow to spread.