$1.6 billion shaved off Michigan property tax bills

Thousands of Michigan home and business owners have been the recipients of hundreds of millions of dollars in property tax cuts in recent years -- a savings that few seem to recognize.

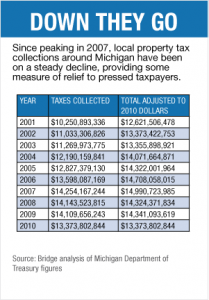

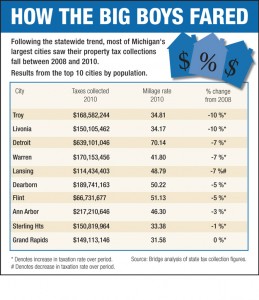

Property owners in the state as a whole have seen property taxes fall nearly $900 million between 2007 and 2010. Adjusted for inflation, the reduction is $1.6 billion, about the same as the business tax cut Gov. Rick Snyder pushed through the Legislature earlier this year. (Between 2008 and 2010, the cuts were $770 million in raw numbers and $951 million adjusted for inflation.)

“Clearly that has been a tax cut for citizens, even though property tax rates have increased slightly,” said Patrick Anderson, president of East Lansing-based Anderson Economic Group. “We probably have another few years of this left” before values bottom out.

This "Shadow Tax Cut" has eased the burden on Michigan residents and businesses in recent years, perhaps to a degree few realize.

BRIDGE DATA: See how taxes changed in your hometown

Michigan property tax revenues have fallen $880.3 million between 2007 and 2010, a 6 percent decline, according to Treasury Department data analyzed by Bridge.

Included in that figure is a $324 million cut in commercial, industrial and utility real and personal property taxes, also a 6 percent decline since 2007.

Included in that figure is a $324 million cut in commercial, industrial and utility real and personal property taxes, also a 6 percent decline since 2007.

This business tax cut comes at a time when business lobbying groups are pushing for the elimination of the state personal property tax, which raises about $1.2 billion a year, mostly for local governments and schools.

Individual tax bills vary, of course. But whether or not they realize it, Michigan property owners have benefited from property tax relief for years, said Craig Thiel, director of state affairs at the Citizens Research Council of Michigan.

Proposal A, passed by voters in 1994, limited annual increases in the taxable value of property to the rate of inflation or 5 percent, whichever is less.

The net effect of Proposal A for homeowners has been a tax cut because it limited the rise in taxable values of property during years when market values were rising faster than the Proposal A cap, Thiel said.

“Now we’re enjoying lower property taxes because the value of the asset is declining,” he said. “Now you see it in your wallet.”

But the impact of that tax cut has been minimized for a variety of reasons. For many taxpayers, the cut in their property tax bills and declining incomes have “canceled each other out,” Thiel said.

Michael LaFaive, director of fiscal policy at the Mackinac Center for Public Policy, a free market think tank, agreed.

“It only comes because they’re poorer,” he said. “That’s not a tax cut to me. That’s just a recognition that people aren’t as wealthy as they once were.”

Michigan has become poorer over the past decade, but the numbers show that property taxes have fallen at a faster rate than incomes over the past three years.

About this projectTo assess the effects of declining property values on tax collections and household budgets, Bridge Magazine took data from the Treasury Department gleaned from all ofMichigan's local governments. The result was a $1.6 billion cumulative tax cut between 2007 and 2010, adjusted to 2010 dollars. |

Property tax revenues, adjusted for inflation, have fallen 11 percent since 2007, according the Bridge analysis. But real per capita income was essentially flat in that period, falling just $153 to $32,192 in 2010

But how have the tax cuts benefited home and business owners? And what impact has lower property taxes had on the state’s economy?

Michigan State University economist Charles Ballard said, to his knowledge, there has been no formal study of those questions. But he, other experts and property owners offer a number of explanations.

Some of the decline in state property tax revenue is a result of foreclosures and business closings, so it’s not really a tax cut for those who have lost homes and businesses. There are 78,693 foreclosed homes in Michigan, according to the latest statistics from RealtyTrac, a foreclosure data service in Irvine, Calif. The state has consistently been among the top 10 states for foreclosures in recent years.

And for many homeowners, the tax cuts they’ve received from declining values might not have been big enough for them to recognize, said pollster Bernie Porn of EPIC in Lansing.

Porn said when voters are asked in his surveys about property taxes, more say they’ve gone down than those who say they’ve gone up. But about half of them usually say taxes have stayed the same.

Voters in Lansing and other communities earlier this month approved higher millage rates to fund police, fire and other services, in part, by convincing voters that their taxes would still decline because of falling property values.

(Residential property taxes in Michigan are calculated by multiplying the total millage by the home’s taxable value, which should be 50 percent of its true cash value.)

“In some areas that’s a persuasive argument,” Porn said. “In other areas, it doesn’t mean a darn thing.”

Walt Sorg, a retired talk radio host and Democratic candidate for a state House seat in Lansing, is persuaded.

Sorg said the value of his Lansing condo, which he bought in 2005, has fallen about 50 percent. His tax bill is about $1,000 a year less than when he purchased it, even with the passage of several tax hikes during that time.

Most of his savings are being spent to reduce debt, he said.

“Everybody likes a tax cut,” Sorg said. “But when I dial 911, I want someone to respond. I want fire and police services and good roads. None of the cost of providing those things has gone down 50 percent.”

Some economists say Michigan’s decade-long recession, which destroyed more than 800,000 jobs, forced many homeowners to spend their property taxes on necessities, such as food and prescription drugs that are exempt from sales taxes.

“Nobody is spending it,” said University of Michigan economist Don Grimes. “To the extent they’re spending it, they’re spending it on necessities.”

“Nobody is spending it,” said University of Michigan economist Don Grimes. “To the extent they’re spending it, they’re spending it on necessities.”

Ballard said he thinks most of those not spending their tax cuts on necessities are either saving it or using it to pay down debt.

“A large number of people are over their heads in debt,” he said. “They’re funneling some of it into paying student loans or paying off credit cards. It means they’re not putting that money into buying stuff.”

A new report by the Southeast Michigan Council of Governments, a regional planning agency, shows Michigan residents have been reducing debt as property taxes have fallen.

Total household debt in Michigan, including mortgage debt, has fallen from an average $41,000 in 2008 to $36,000 in 2010, according to SEMCOG.

Lower property taxes have been at least partially offset by higher income taxes for taxpayers who can deduct property taxes on their federal income tax returns.

Mike Maziasz, a General Motors retiree living in Troy, is one of those taxpayers. Overall, Maziasz said he thinks lower property values are a bad thing, particularly for retirees who want to move to a warmer climate, but can’t sell their homes without taking big losses.

“Is it a little easier to write the (property tax) check? Yes,” he said. “Do I like having a reduction in my property value? No.”

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!