Billions more lost, but property value drop slowing

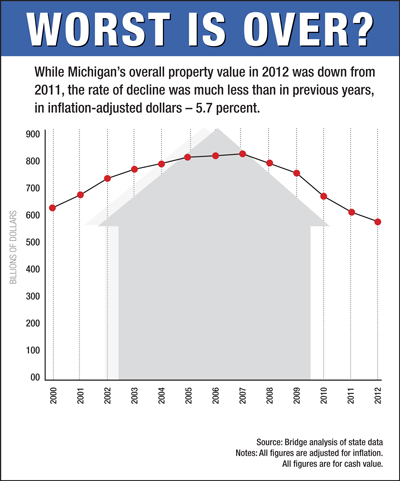

In five years, total Michigan property values plunged by more than $260 billion, according to an analysis of state records by Bridge Magazine. But while the decline continued over the last year, it slowed considerably.

Values dropped from $725.5 billion in 2011 to $698.6 billion in 2012. Adjusted for inflation, that amounts to a drop of nearly $36 billion in value for residential, industrial, commercial, timber, development and personal property.

On the plus side, preliminary assessment data reported by the Detroit Free Press for Southeast Michigan point to a recovery in a housing market battered by years of falling prices and sales. According to 2013 data, based on houses sold between October 1, 2011 and Sept. 30, 2012, Oakland County housing values are up by about 1 percent. In Wayne and Macomb counties, the values fell by about 1 percent.

That compares to a 4 percent drop in Oakland County in 2012 and 6 percent in Wayne and Macomb counties in 2012.

Statewide, home sales in 2012 reached the highest volume since 2005.

TRAVERSE CITY, ANN ARBOR HOME SALES POINT TO BRIGHTER 2013

“It's a signal of general economic strength,” said Charles Ballard, a Michigan State University economist.

But Ballard said that any recovery will be hampered by the fact that Proposal A, passed by voters in 1994, limits increases in residential taxable value to 5 percent or the rate of inflation, whichever is less. That will crimp how quickly cash-strapped municipalities can recoup years of dropping property values.

But Ballard said that any recovery will be hampered by the fact that Proposal A, passed by voters in 1994, limits increases in residential taxable value to 5 percent or the rate of inflation, whichever is less. That will crimp how quickly cash-strapped municipalities can recoup years of dropping property values.

“What has happened is we have locked in today's low property values. If there is a strong rebound, it cannot be captured because of Proposal A,” he said.

“We didn't get into this mess overnight. It won't be fixed by next Tuesday.”

Public services caught in echo effect

State and local governments levied $1.3 billion less in property taxes in 2011 than 2007 because of declining property values and exemptions from the tax, according to Treasury Department figures. That has spelled layoffs and cutbacks in everything from police and fire protection to schools.

WHAT’S PROPERTY WORTH IN YOUR HOMETOWN?

Some of the decline in tax revenue stems not from lower tax bills, but from home foreclosures or firms that went out of business. Michigan ranked eighth in the nation in the rate of foreclosures in 2012, according California-based RealtyTrac.

The dip in tax revenue even hit communities like Huron Township in Wayne County, which in December laid off four full-time police officers and four part-time officers. For a community of just under 16,000, it meant a one-third reduction in its police staffing.

Declining property tax revenues forced that decision, according to Supervisor David Glaab. In 2009, Glaab said, it generated $2.5 million from a 5-mill assessment dedicated to police funding.

“We're under $2 million now. That's what's driving all the cuts in personnel.”

Glaab forecast two more years of declining revenue in his community before it turns around.

“We're hoping by 2015 we'll have things stabilized. We've got some more pain to endure.”

Grand Rapids hit hard; Flint crushed

In Grand Rapids, officials cut the engineering department's 35-person staff by 14 positions at the end of 2011 as the city continued to slash spending to right its fiscal outlook. It has cut about a fourth of its work force since 2009.

HOW ARE PROPERTY VALUES CALCULATED?

Grand Rapids total property value declined by 15.2 percent from 2007 to 2012 and by 4.8 percent from 2011 to 2012. Adjusted for inflation, its drop in property value from 2007 to 2012 was 23.4 percent. It was 6.7 percent from 2011 to 2012.

In Detroit, total property value plunged by 33.1 percent from 2007 to 2012. Adjusted for inflation, that amounts to a fall of nearly 40 percent.

Gov. Rick Snyder recently named Kevyn Orr as emergency manager for Detroit, which has some $14 billion in long-term bond debt and retiree pension and health-care benefits and a deficit that could exceed $400 million this year.

Flint's budget deficit climbed to $19 million in 2012, the result of declining property tax revenues and disappointing income tax revenues. Its total property value fell by 35.7 percent from 2007 to 2012 and by 11.7 percent from 2011 to 2012. Adjusted for the inflation, the drop from 2007 to 2012 was nearly 56 percent and about 20 percent from 2011 to 2012.

DETROIT’S PROBLEMS ECHOED IN A (FAR) SMALLER FLINT

The drop in value was steepest in Southeast Michigan, which generates about 50 percent of Michigan's economic activity. Among the seven counties which comprise the Southeast Michigan Council of Governments, the drop in value from 2007 to 2012 ranged from a 21 percent drop in Wasthenaw County to a 35 percent decline in Macomb County. It was 34 percent in Wayne and Oakland counties.

Of course, the collapse of the housing market five years ago did more than shrink municipal budgets and services.

Asset loss hampers economy

Before that, rising real estate prices and routine approval for home equity loans gave homeowners ready access to extra cash. They leveraged their homes to buy cars, TVs and other consumer goods, purchases that kept the economy going.

Falling home values and tighter credit pulled the plug on that spending spree. Homeowners who might have pursued job opportunities in other locations stayed put because they couldn't afford to sell their home at a loss.

“For many of us, our home is our largest asset,” said George Erickcek, an economist with the W.E. Upjohn Institute for Employment Research in Kalamazoo. “Even if we are employed or not interested in moving, we feel poor. That affects how we spend.”

But he, too, notes there is encouraging news.

Realtors sold more than 124,050 homes in Michigan last year, a rise of nearly 10 percent from 112,900 sold in 2011, according to the Michigan Association of Realtors. The figures do not include homes sold by owner.

The average sale price of these homes reached nearly $111,000, up 5.6 percent from about $105,100 the prior year. That marks the highest average sale price since $118,400 in 2008.

The statewide average price of $111,000 still came in 28 percent lower than the 2005 average of $153,300.

“It looks like assessed values are starting to climb,” Erickcek said.

But Erickcek echoed economist Ballard's concern that Proposal A will limit how fast taxable value can rise. That means any climb out will be slower than the plunge.

“I think that's going to be one of the biggest issues,” he said.

Ted Roelofs worked for the Grand Rapids Press for 30 years, where he covered everything from politics to social services to military affairs. He has earned numerous awards, including for work in Albania during the 1999 Kosovo refugee crisis.

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

Huron Township Supervisor David Glaab: “We're hoping by 2015 we'll have things stabilized. We've got some more pain to endure.” (courtesy photo)

Huron Township Supervisor David Glaab: “We're hoping by 2015 we'll have things stabilized. We've got some more pain to endure.” (courtesy photo)