Guest commentary: Owosso’s budget woes are warning to state policy-makers

By Tom Cook

The city of Owosso has a budget problem -- and has had one for the last five years. Good management, tough policy decisions and sacrifices by residents and employees of the Shiawassee County community have carried the city to this point. But without some further difficult choices and structural reforms, the situation will not improve next year or the year after, even if the economy recovers.

In 2007, Owosso was enjoying several years of modest growth; rising property values translated into increasing revenues for the city. In 2008, a large new grant was secured to help make improvements in downtown. Then the stock market collapsed on Sept. 20, 2008.

The ensuing economic downturn has persisted to the present day. While the national economy is recovering, and employment and incomes are up, property values -- the primary driver of city revenues -- have continued to fall. In addition, state revenue sharing has suffered significant cuts and government grants have dried up.

Owosso responded in three ways:

--Aggressive cuts in city spending, primarily by reducing the number of employees and the benefits of remaining workers.

--A modest 1 mill increase in taxes to pay for city services.

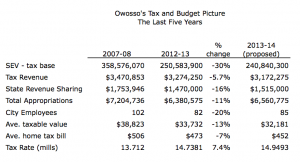

--Renewed efforts at economic development and neighborhood improvement in an attempt to increase, or at least maintain, property values. The graphic at right paints the picture.

The most difficult number is the first one. Owosso’s “equalized value” has declined 30 percent in the last five years. Not surprisingly, tax revenues dropped by $200,000 in the same five years, and are projected to drop another $100,000 this budget cycle. The drop would have been even greater but for the fact that the City Council, in 2010, approved a tax hike from 13.7 mills (tax dollars per $1,000 value) to 14.7 mills (the decimal changes in the table reflect small changes up, and down, due to bond and other obligations).

Years of budget pruning

Budget cutting has been the preoccupation in City Hall. Employee ranks were cut from more than 100 to around 80 now. Workers have seen their benefits reduced and they have stepped up to higher contributions to their health care. Overall, close to $900,000 in spending was cut from the budget.

Making these cuts without drastic reductions in services is to the great credit of talented administration and hard-working employees. Owosso has a history of careful spenders, who kept the lid on employment costs, did not indulge in big projects and always limited services. Fortunately, they also left the city with a healthy reserve and little debt.

MORE COVERAGE: New rankings find fiscal troubles for city halls across Michigan

While the decline in property values has hit the City's budget hard, it has provided some relief to taxpayers in Owosso. The average tax bill paid by a homeowner has declined from $506 in 2007 to $473 last year, and this occurred despite the 1 mill increase in in 2010.

So, now what?

Still, the city faces both an immediate budget crisis and a long-term challenge in ensuring sufficient revenues. For the coming budget year (which begins July 1) the city has only a few options:

--Reduce labor costs through cuts in services. To reduce the cost of government further it will be necessary to have fewer public safety employees and/or less maintenance of roads and parks.

--Delay further equipment purchases. The city has postponed for five years the purchase of new trucks, a streetsweeper and a new ambulance. At some point the cost of maintaining old equipment becomes prohibitive.

--Increase fees and the property tax rate. Neither of these revenue-generating options is desirable.

--Tap the reserves. This move could hurt, though, the city’s ability to borrow money easily and cheaply.

The council has been seeking alternatives, professional advice and public input. Whatever happens with this year's budget, the challenges will persist. Even if the real estate market recovers in the coming year and property values rebound, property tax revenues will not rise quickly because of the provisions of Prop A that limit the rise in taxable values. Even if property values rise 10 percent in 203-14, or the next year, the city's revenues are likely to rise only 1 percent or 2 percent.

There may soon come a time when Owosso has to decide on more radical measures, such as:

--Significantly scale back or outsource public services, or move to a fee-for-service system.

--Ask nonprofit entities that are exempt from property taxes, like health-care providers and private educational institutions, to make payments in lieu of taxes.

--Approve even more new taxes.

--Get relief from the state, either through revenue-sharing or Prop A changes.

Owosso’s problems are far from unique. Plenty of other communities are in budget crunches. So, what advice do you have for your elected representatives?

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

Tom Cook is a member of the Owosso City Council and executive director of the Cook Family Foundation.

Tom Cook is a member of the Owosso City Council and executive director of the Cook Family Foundation. Chart by Tom Cook. CLICK TO ENLARGE

Chart by Tom Cook. CLICK TO ENLARGE